The illusion of Climate & Weather Insurance

April 15, 2025

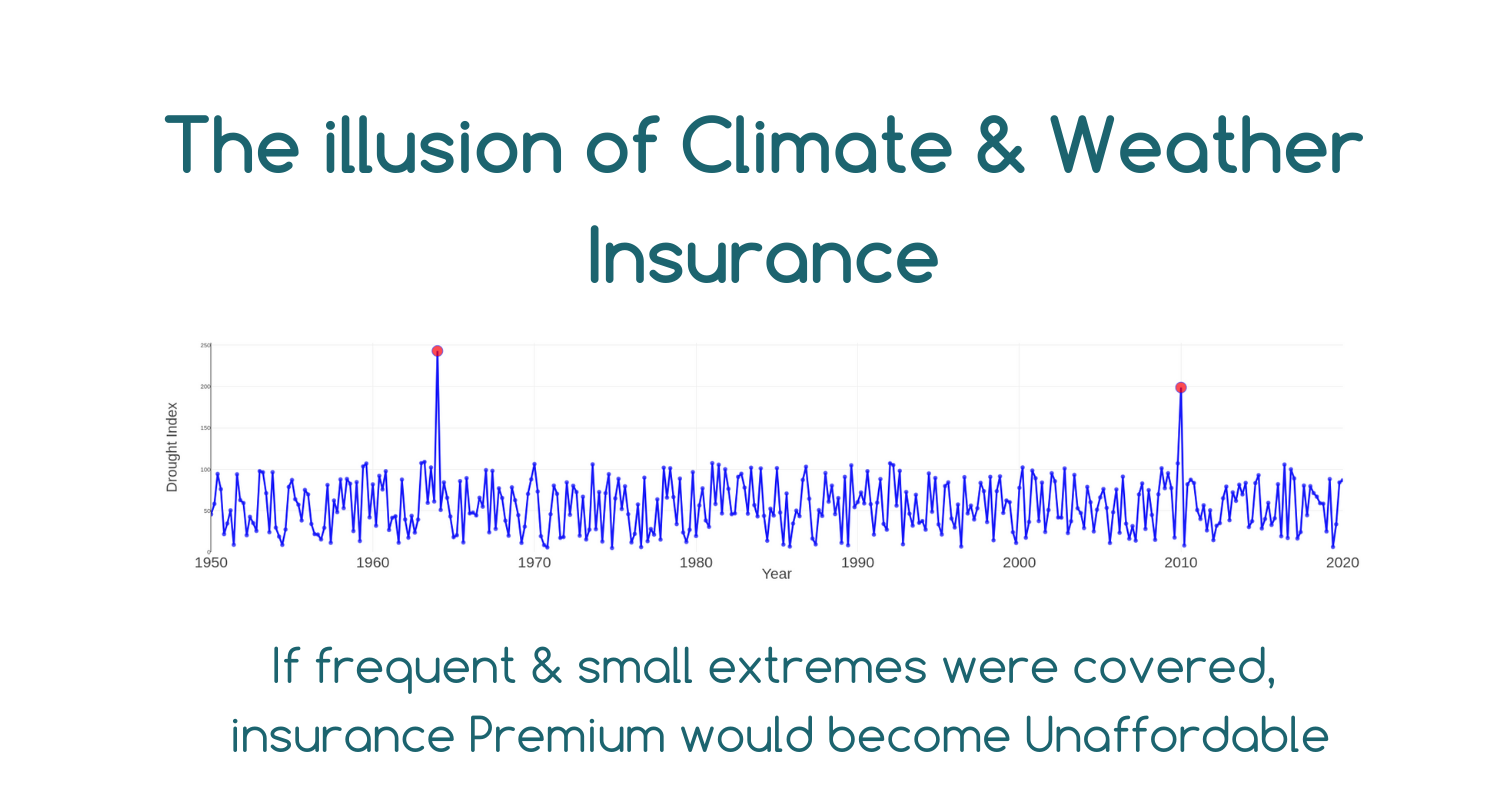

Did you know that basic insurance policies do not cover weather extremes and climate perils that occur frequently — once every 10, 20, 50, or 100 years?

It’s simple: if frequent events were covered, the expected loss would be too high, and the annual premium would become unaffordable.

No one would be able to buy flood and wildfire insurance policies in this case.

Another important fact: by default, basic insurance contracts exclude a wide range of climate-related perils, including sea level rise, landslides, droughts, cold stress, spring frost, hail, water stress, and heatwaves.

Moreover, the few perils that are covered refer only to catastrophic (extremely rare) events with return periods of 300 or 500 years.

Severe weather events of the "good type," but with lower thresholds — those occurring once every 10, 20, 50, or 100 years, and thus far more likely — fall outside the scope of basic insurance coverage.

As a result, the physical climate risk assessments provided by insurers (and by their sister companies or "independent" advisory departments) focus mainly on these super-rare events and a limited number of hazards.

Yet for corporate risk management, this limited information is not sufficient.

Companies need detailed insights into all potential risks and exposures across many time horizons, including everything that happens once every 2, 5, 10, 20, and 30 years.

For climate risk assessments to be actionable, they must match the timeframe of corporate planning and decisions.

I hope this knowledge sparks a much-needed rethink of corporate risk management.